- #Best budget planning app update#

- #Best budget planning app for android#

- #Best budget planning app android#

- #Best budget planning app verification#

Mint Premium is currently developing for web and Android versions but is available for iPhone IOs only. The best way to see which are available at any given time is to create an account, even a blank one, and then search for “Add Accounts” and see the list of financial institutions. The banks and financial institutions list are constantly changing. The games will provide you with saving and spending tips upon completion of stages. There is also a Spending Graph visualization in this subscription version with new options in the upper left corner of the screen: The Download icon and The Filter icon. And, as part of “Premium,” included are two games: Dodge the Debt and Slither into Savings. The subscription version of Mint offers additional data visualizations and allows customers to visualize their financial standing better to better plan and adjust for their financial goals. 99 cents a month for no ads plus all premium features.

#Best budget planning app for android#

It is not available on the Web or for Android devices yet.

#Best budget planning app verification#

Usually, you’ll get a verification code sent through a text message or automated phone call.Īny time you sign in to an existing Intuit Account on an unrecognized computer or device, we’ll first ask you to verify your identity. Two-step verification is a financial industry standard that requires you to provide additional verification after signing in. They utilize two-step verification or two-factor authentication/multifactor authentication. Tools include a retirement calculator, credit card payoff calculator, net worth calculator, grocery budget calculator, home affordability calculator, Loan calculator, budgeting calculator, investment calculator, travel budget calculator, and a student loan calculator.

#Best budget planning app update#

If your financial institution or bank does not connect and share data with Mint, you will have to add a manual account and then update it accordingly to keep it current.

They also have live chat support that can answer any of your questions. Mint also has a free version, and you get access to your free credit score 24/7 and alerts you to any credit changes.Ĭryptocurrency investment accounts are easily added, and financial institutions including Coinbase, Bitmart, Binance, and Gemini can be synced. With Mint, all your finances are managed through one powerful app.

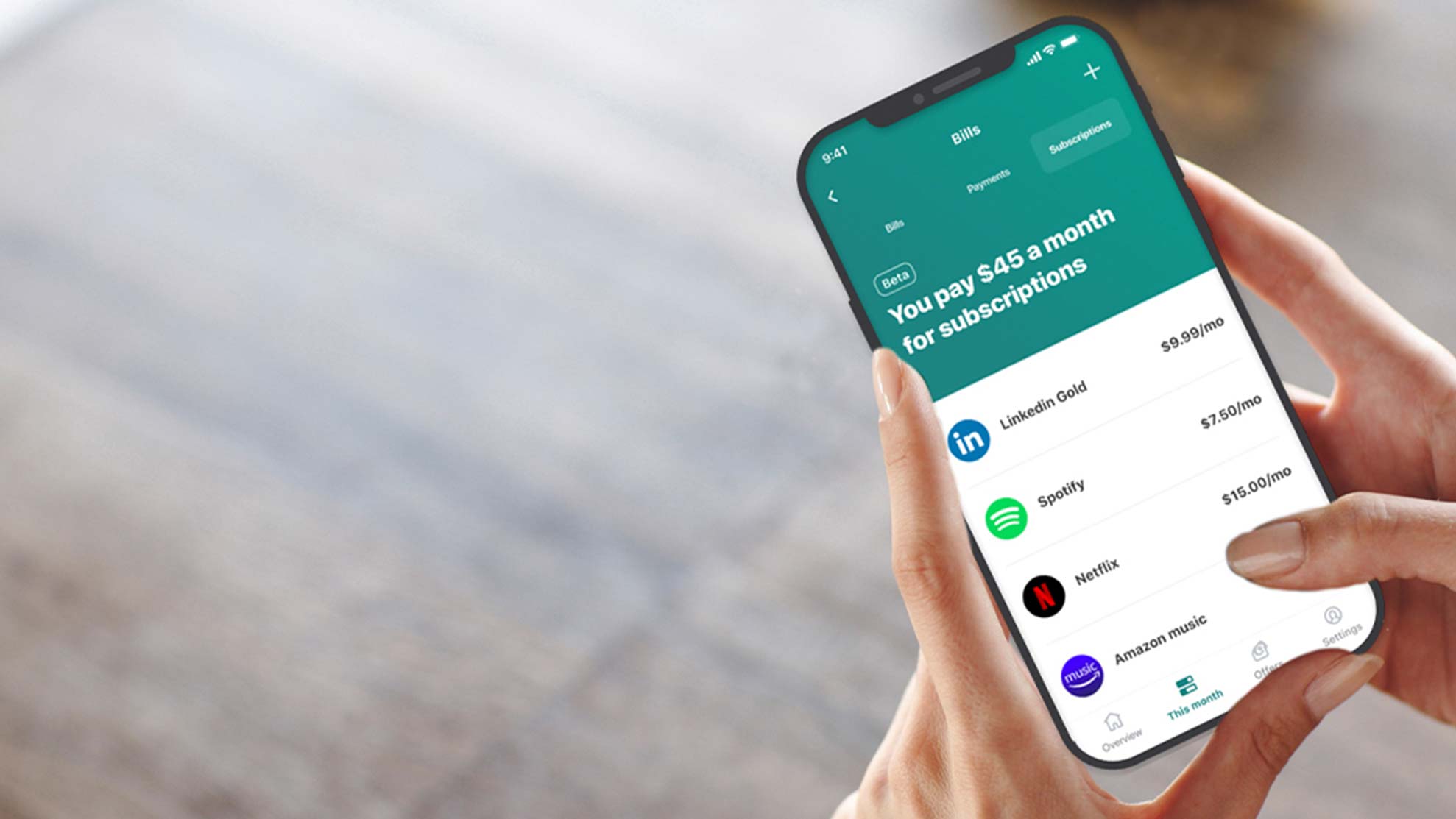

Create custom budgets that help you save: You can easily create a budget in Mint.You get notified when your subscription costs increase and when bills are due. Cash flow tracking: The app helps you stay on top of your accounts, bills, and subscriptions.You get notified before they’re due, if there’s a price increase, and when fees are detected. Bill and subscription tracker: Let’s you know what you’re paying and when.Mint is an all-in-one app from Intuit, the maker of Quickbooks, that brings everything together all your spending, cash flow, balances, budgets, credit score. Mint is a powerful app that connects to all your accounts cash, credit, loan, and investment accounts. Best zero-base budgeting framework: EveryDollar.Best if you don’t want to sync accounts: Fudget.Best for long-term financial planning to boost net worth: Personal Capital by Empower.Best if you need simplicity: Simplifi by Quicken.Best to help couples set spending limits: Honeydue.Best for debt payoff: Debt Payoff Planner.Best to save money if you’re starting out: Stash.Best to manage student loans: Fidelity Spire.Runner-up for the envelope method: Mvelopes.Best for the envelope budgeting system: Goodbudget.Best app for setting savings goals: YNAB ().

0 kommentar(er)

0 kommentar(er)